The capacity to anticipate patterns and shifts in the complex financial market is paramount. Investors rely on stock prediction to help them navigate this unpredictable landscape. It uses historical data and advanced analytical tools to look at the stock market’s future. How we make investments has evolved due to the convergence of information technology and the financial markets. Stock prediction is fundamental to current investing methods, and this article will examine its foundational principles, including its use of data science approaches.

Stock market values are affected by a complex network of elements, including economic data, geopolitical events, investor mood, and more, making it essentially an ever-changing ecosystem. Aiming to find patterns amid disorder, stock prediction attempts to decipher this complexity to foretell how prices will move in the future.

Trading fractional shares of ownership in publicly listed companies is the whole idea behind the stock market. It allows thousands of millions of people to own a piece of the biggest firms in the world. The value of such enterprises is determined by the purchasing and selling choices of those investors. People may haggle over pricing at the market. By delivering the best feasible sale price and the best possible purchasing price at a particular moment, this negotiating approach maximizes fairness for both sides. The price and volume of equities traded on any given exchange are constantly monitored.

A dataset is extracted from Kaggle website. The dataset based on the stock price for Tesla company. The data link is in the following:

https://www.kaggle.com/code/serkanp/tesla-stock-price-prediction/input

2 years of data are filtered such that 2018 and 2019 stock prices of Tesla.

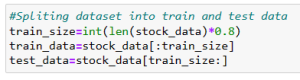

The codes and the analysis are described below with the help of Python. Here 2 stock prediction models are built based on the data. At first, the data is split into 2 categories, train and test.

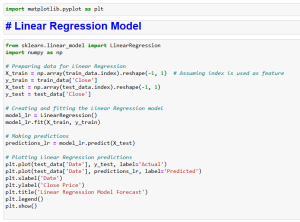

The python code for linear regression is below.

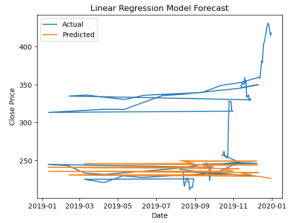

Using Tesla’s stock data as input, the linear regression equation displays significant volatility in its projected values, which differ significantly from actual stock prices till 2020. Linear regression is less successful in predicting the movements of Tesla’s stock because of its notorious volatility, which causes it to react to unexpected market forces. Given this discrepancy, the model’s linear assumptions may be at odds with Tesla’s stock behavior, which would reduce the model’s predictive power.

Explanation

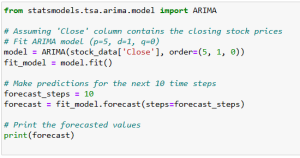

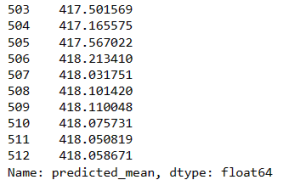

Applying ARIMA and other predictive models to Tesla’s stock information may reveal possible price movements in the future. Using past trends, this forecasting tool may help Tesla anticipate potential stock price swings. In order to find trends, seasonality, and other recurring trends in Tesla’s stock behavior, the ARIMA model examines previous stock values.

But there are a lot of other forces that may affect Tesla’s stock price, including as new technologies, market mood, changes in regulations, and Elon Musk’s statements to the public. Because of the importance of these factors, it is difficult to capture the whole market environment with only statistical forecasts for Tesla’s stock performance.

The results of ARIMA should be taken with a grain of salt, even if they may suggest future price changes. Their analysis may be used to deduce patterns in the past and to foretell possible outcomes in the future. The model’s ability to predict unforeseen news or business disruption is tested by the notoriously volatile and rapidly fluctuating Tesla stock.

Unpredictability and Flexibility in the Market: The difficulty predictive models encounter is in responding rapidly enough to sudden changes in the market and high levels of volatility. The accuracy of predictions during tumultuous times is an ongoing issue that demands models with fast adjustment capabilities.

Concerns about data ethics and its quality: Data quality plus ethical concerns are ongoing challenges. Challenges in building accurate models include using inadequate datasets, dealing with unreliable sources, and guaranteeing ethical data use. Ensuring confidentiality for users and reducing prejudice are continuous problems.

Considering Unexpected Circumstances: The integration of unexpected occurrences, often known as “black swans events,” into forecasting models remains a persistent obstacle. If we want our models to be more accurate and resilient, we need to make sure they can handle these kinds of surprises.

Model Reliability and Confidence: The development of accurate and comprehensible models is no easy feat. Stakeholder confidence is enhanced when model choices are made transparently. Making important financial judgments requires the use of explainable AI approaches.

Due to its vulnerability to outliers and complicated interactions between many external variables impacting stock prices, linear regression may fail to reflect Tesla’s nuanced price movements, in contrast to the ARIMA model. When applied to a broader strategy, ARIMA findings might be useful for Tesla’s analysts and investors. Making educated judgments requires integrating quantitative predictions with qualitative evaluations and up-to-the-minute market data. To summarize, while ARIMA can have predictive capabilities, a comprehensive methodology is required to make informed investing decisions inside Tesla’s complex stock dynamics.